When trust, confidentiality, and compliance are non-negotiable.

Every day, banks, insurance companies, and FinTechs across Germany rely on Teamwire for fast, secure, and fully compliant communication — effortlessly meeting the requirements of the DORA regulation along the way.

Typical challenges in banking and financial services

Digital transformation and regulatory pressure are reshaping the financial sector at unprecedented speed. DORA, NIS-2, BaFin regulations, cyberattacks, and rising customer expectations are placing increasing demands on IT and compliance teams. Traditional communication tools — such as email, phone, or outdated internal systems — can no longer keep pace with this complexity.

Why Teamwire is the ideal Messenger for banks and insurances

Work collaboratively — with full DORA compliance and complete data sovereignty

Confidential client data and internal financial information demand absolute security. Teamwire guarantees the highest data protection standards as a specialized messenger for banks and insurance companies. — 100% sovereign, fully GDPR- and DORA-compliant, built on a zero-trust architecture, and entirely under your control.

Complete data sovereignty

You decide where your data is stored, how long it is retained, and who has access. All information is hosted exclusively in certified German data centers — with no access by third parties or non-EU authorities. Data sovereignty isn’t just part of our promise — it’s part of our DNA.

Robust end-to-end encryption

Messages, metadata, attachments, and media files are encrypted at every stage — in transit, at rest, and during storage. Sensitive financial data, client documentation, and internal communication remain secure at all times.

Zero-trust security model

Teamwire is built on a zero-trust approach: every connection, user, and device is continuously verified. This prevents unauthorized access — even in BYOD environments or when working with external partners.

Privacy by design and by default

Our systemwide privacy principles include strong anonymization, no metadata analysis, and no access to address books or private contacts — ensuring total compliance with privacy regulations.

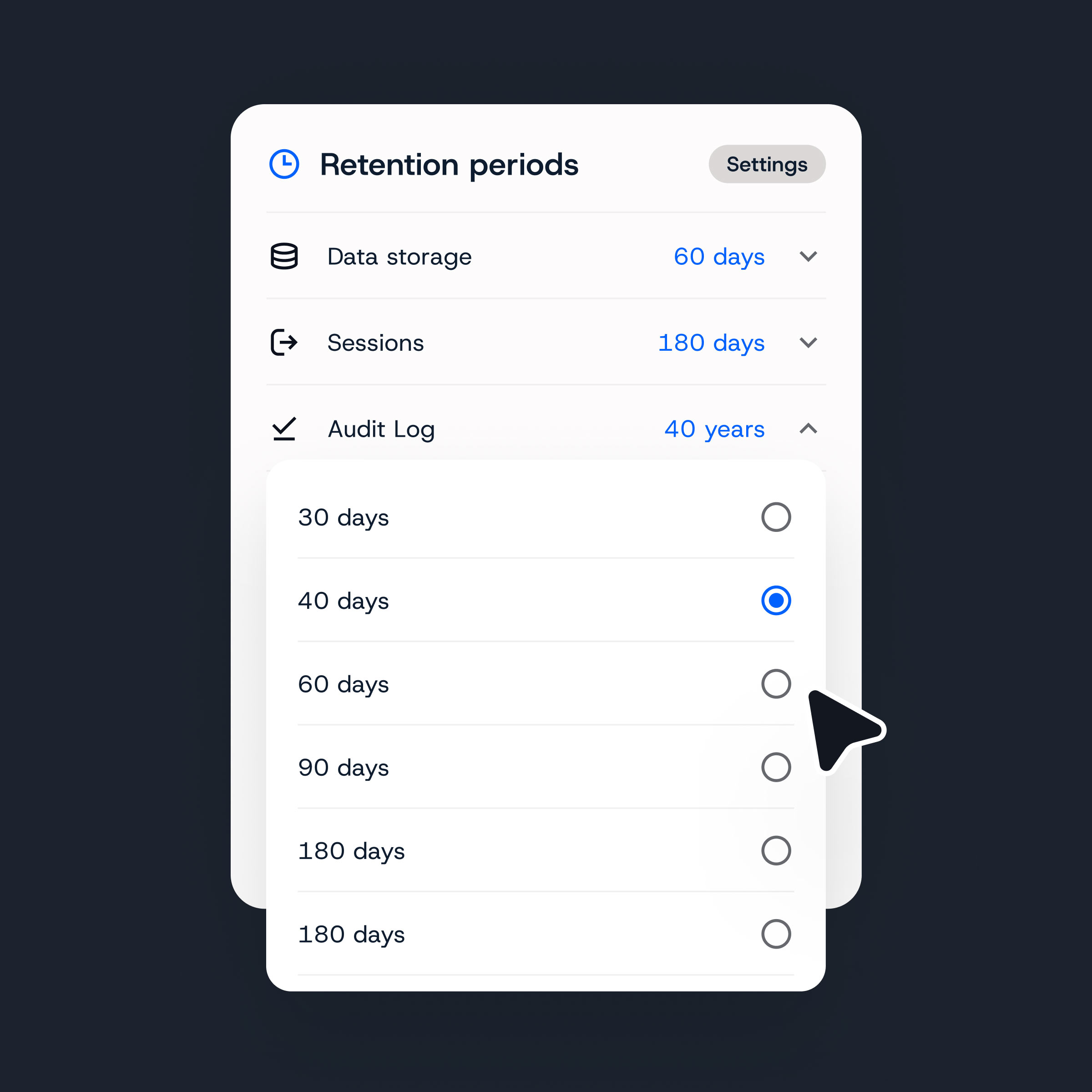

Granular data retention policies

Define more than 50 security and compliance parameters, including storage duration, access permissions, and deletion rules. Internal governance and regulatory requirements are automatically enforced through policy-based management.

Full regulatory compliance

Teamwire fully complies with GDPR, NIS-2, and DORA, supporting audit trails and reporting in line with European financial sector standards.

Certified and audited security

Teamwire and its partners are regularly audited and certified by independent bodies (ISO 27001, BSI C5) and comply with the standards of European financial regulators such as BaFin.

A messenger for banks and insuranced for critical situations

In the financial sector, everything revolves around money and highly sensitive data — and maintaining control over both is crucial, even during system outages. Teamwire operates independently of your core IT infrastructure, serving as a secure fallback communication platform that continues to run seamlessly during outages, cyberattacks, or maintenance windows.

Sovereign hosting — on-premise, private, or public cloud

Choose the hosting model that best aligns with your compliance requirements. Whether on-premise in your own data center or within certified German cloud environments, all options are ISO 27001- and BSI C5-certified and fully DORA-compliant.

Scalable architecture

Teamwire is purpose-built for critical infrastructures and supports organizations with more than 100,000 users. Cluster servers, redundant systems, and intelligent load balancing ensure maximum stability under any conditions.

High availability

Teamwire won’t let you down. The platform provides clustered server environments for mission-critical operations and supports the highest service-level agreements (SLAs).

Automated backups and failover

Regular, automated backups protect your data integrity, and Teamwire can seamlessly switch between servers to maintain uninterrupted communication in the event of an outage.

Complete access control

All access to APIs, systems, and data remains entirely under your control. Teamwire operates completely independently of U.S. providers and guarantees full European data sovereignty.

Instantly access all critical information — without delay

Time is money. Approvals, clarifications, and compliance instructions must be executed quickly, transparently, and in full regulatory compliance. Teamwire ensures that all relevant information reaches the right people at the right time — securely documented, fully traceable, and in real time.

Intuitive to use — just like WhatsApp

Anyone familiar with messenger apps can start using Teamwire immediately — but with full compliance to GDPR, DORA, and BaFin standards. The interface is simple; the security architecture, uncompromising.

1:1 and professional group chats

Create dedicated chats for teams, branches, or departments such as Risk, Trading, Compliance, or IT. This ensures every decision is documented, processes move faster, and information loss is eliminated.

Voice and video conferencing

Handle approvals or clarifications instantly through encrypted voice or video calls with up to 30 participants. Secure, auditable, and ideal for rapid coordination across multiple locations.

Color-coded status messages

Emphasize critical topics — such as approvals, compliance alerts, or security warnings — using color-coded messages. Teams can immediately see what’s urgent, complete with read receipts and timestamps.

Share information, files, and approvals directly with your colleagues

Teamwire offers purpose-built features for banks, insurance companies, and FinTechs to accelerate internal coordination, shorten decision-making processes, and maintain the highest standards of compliance and data protection.

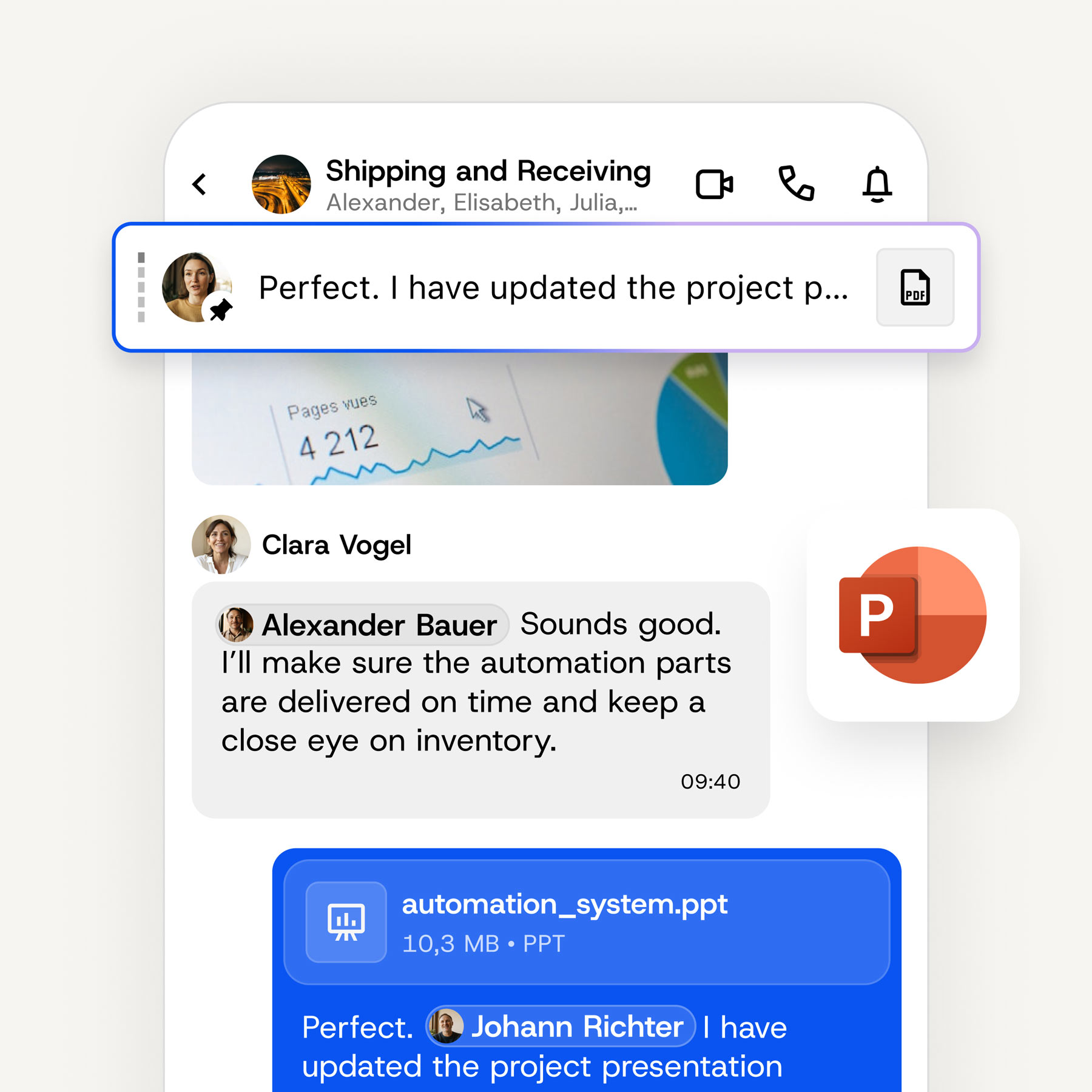

Secure sharing of digital content

Send documents, reports, contracts, photos, or presentations directly to individual colleagues or entire teams. This eliminates overloaded email distribution lists, prevents media discontinuities, and ensures all information stays securely within your organization.

Edit documents and images directly

Add comments, highlights, or annotations directly to documents or images. Confidential sections can be anonymized or hidden — ideal for audit materials, risk analyses, or contract reviews.

Quick polls

Make decisions efficiently: schedule meetings, gather feedback, or conduct quick real-time surveys. Results appear instantly in the chat and are automatically documented for full traceability.

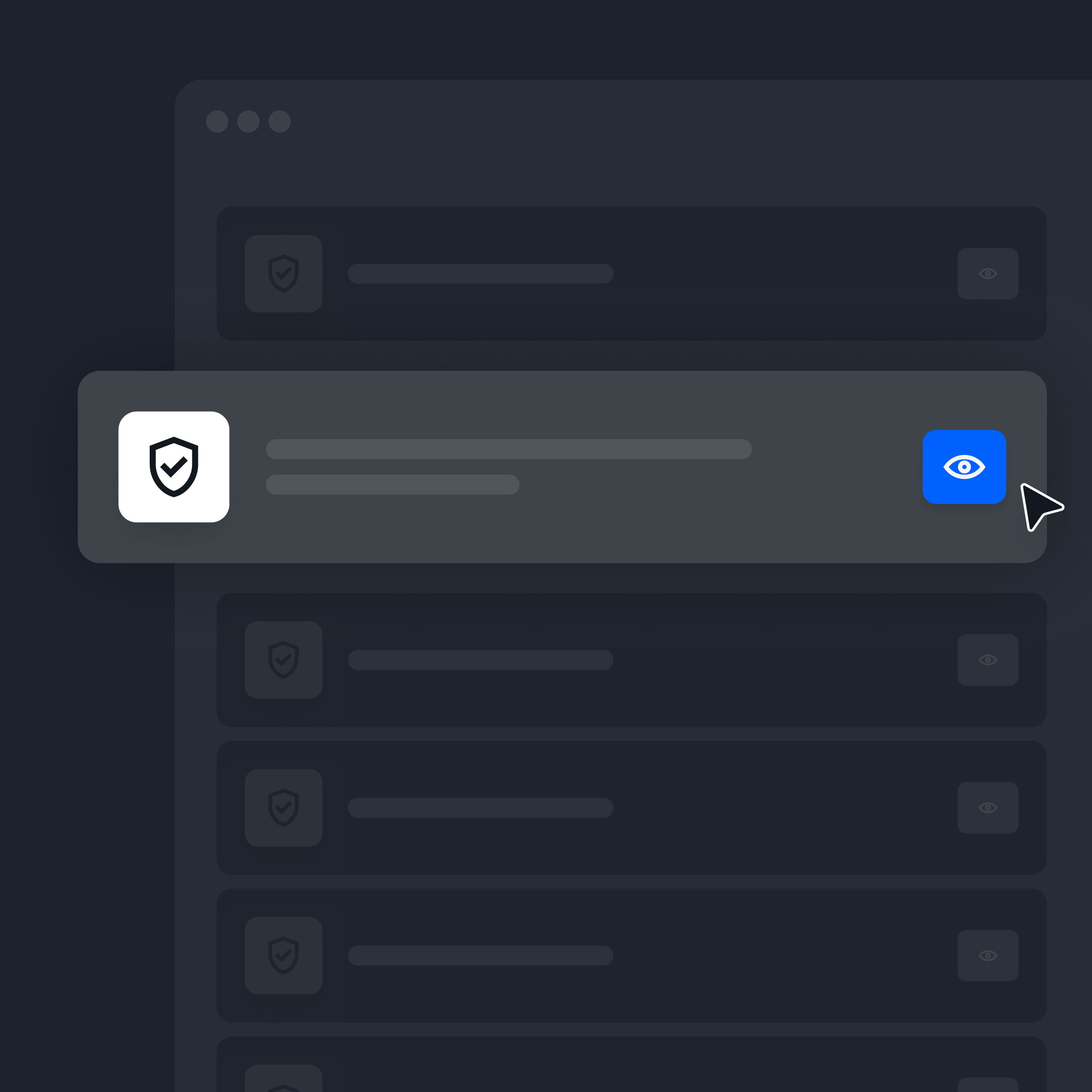

Centrally manage and secure all teams, users, and devices

Say goodbye to communication chaos caused by multiple tools. With a messenger for banks and insurance companies, you can centrally manage all users, endpoints, and policies in just a few clicks — securely, efficiently, and fully audit-compliant. Maintain full oversight of compliance, access rights, and communication flows across your financial organization at all times.

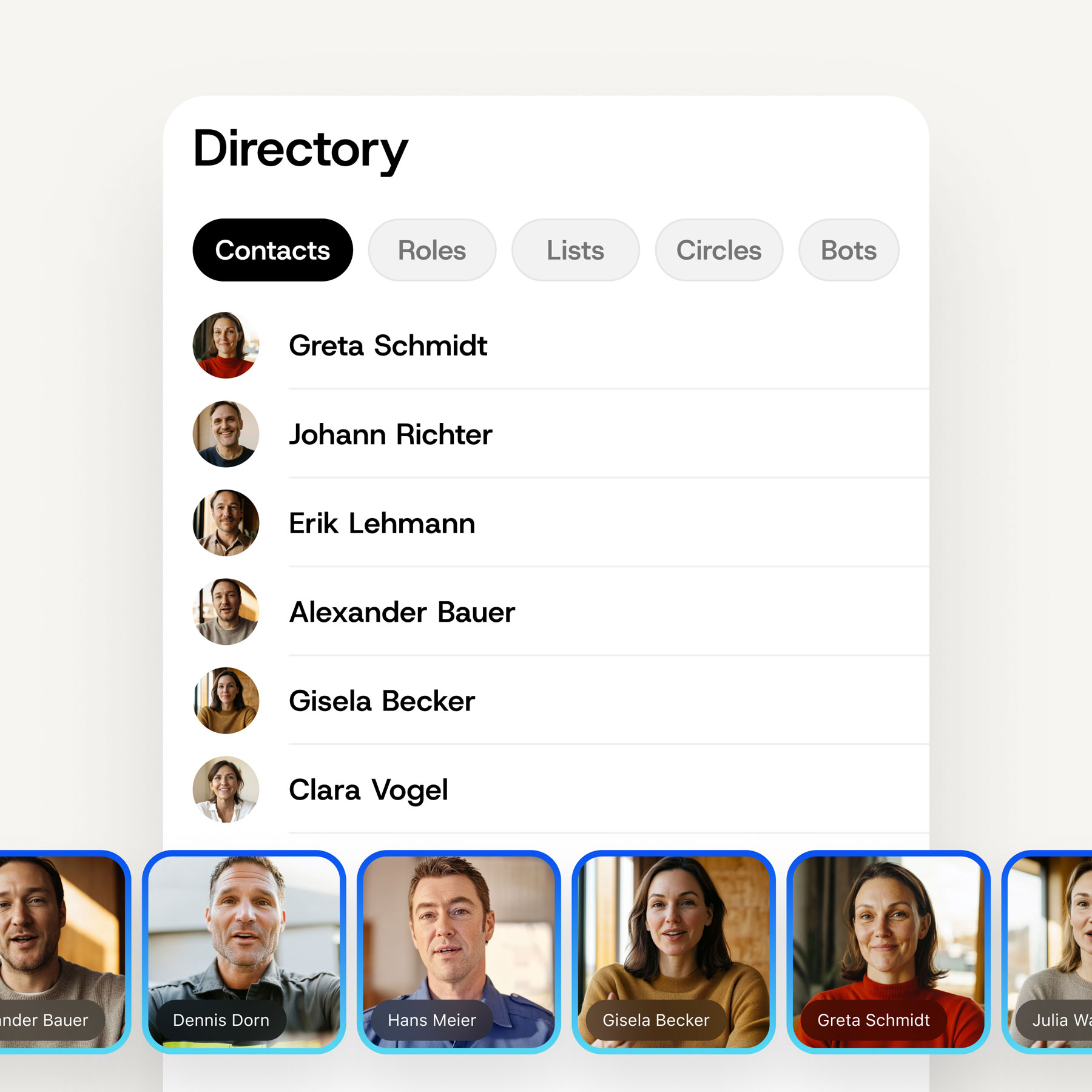

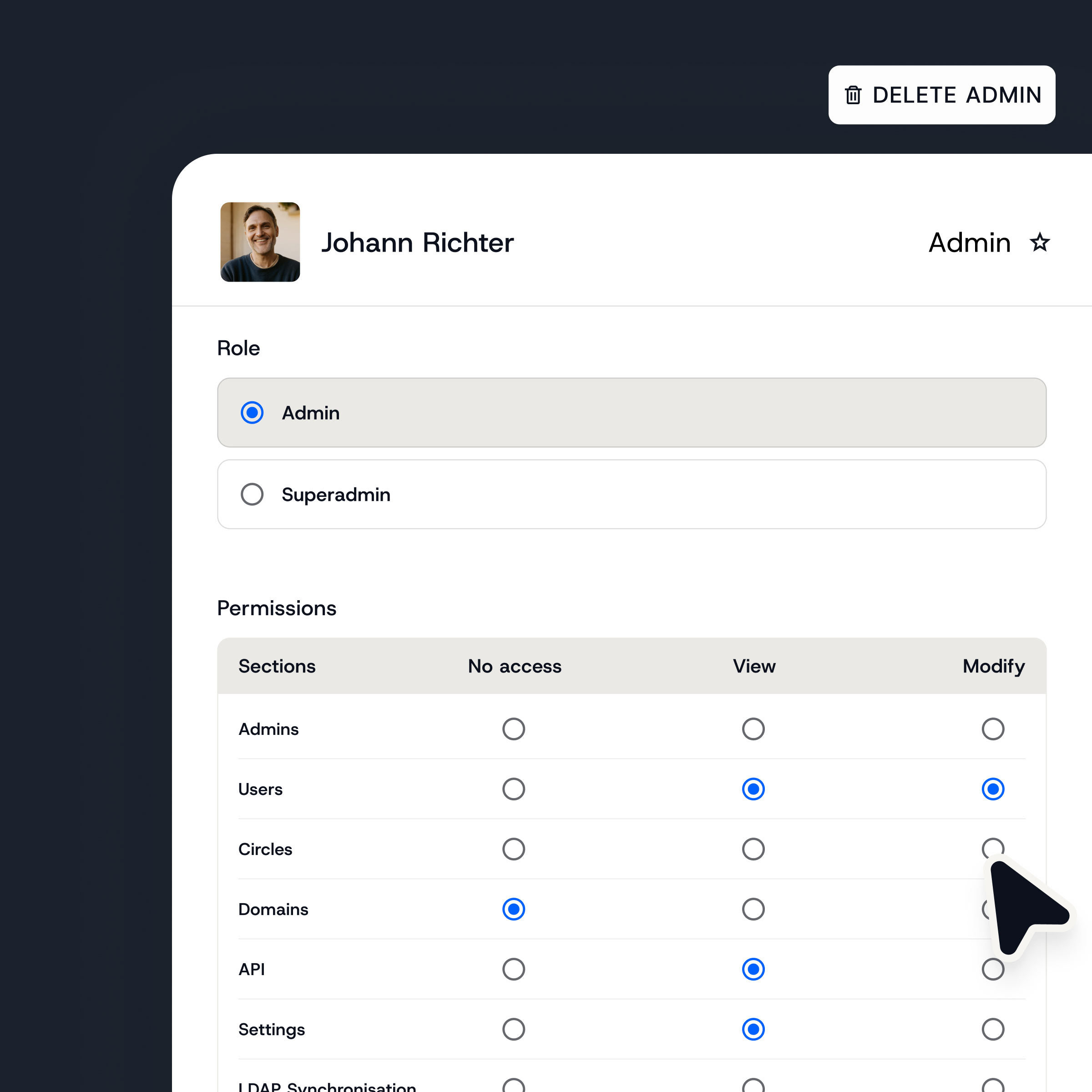

Advanced administration portal

Easily manage access, users, and devices; leverage LDAP or Active Directory synchronization; and rely on audit-proof archiving and logging for complete transparency.

Comprehensive mobile application management

A secure, encrypted container protects confidential corporate and client data — even in BYOD scenarios. Teamwire is fully compatible with all major MDM, EMM, and UEM solutions via AppConfig, enabling centralized control of mobile devices.

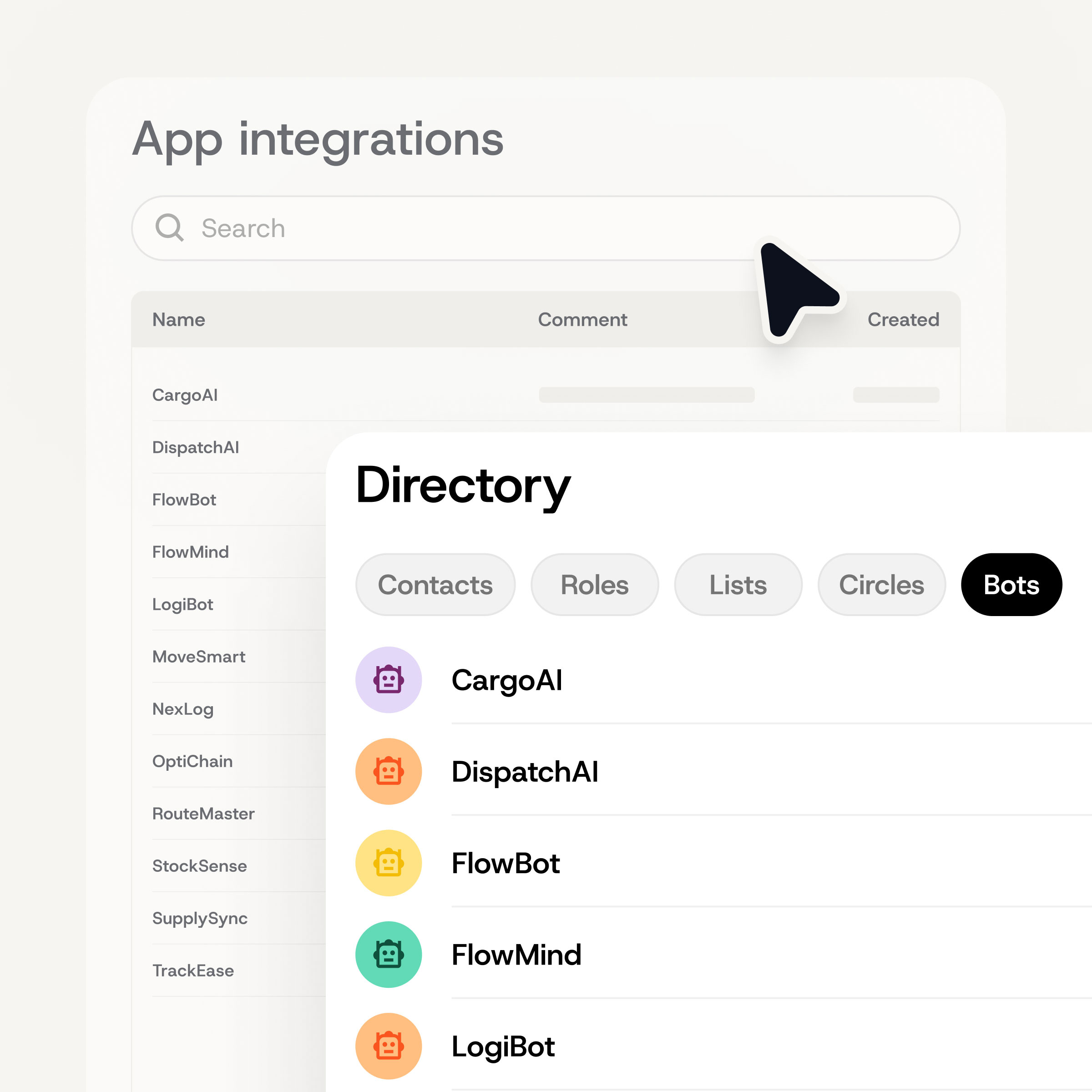

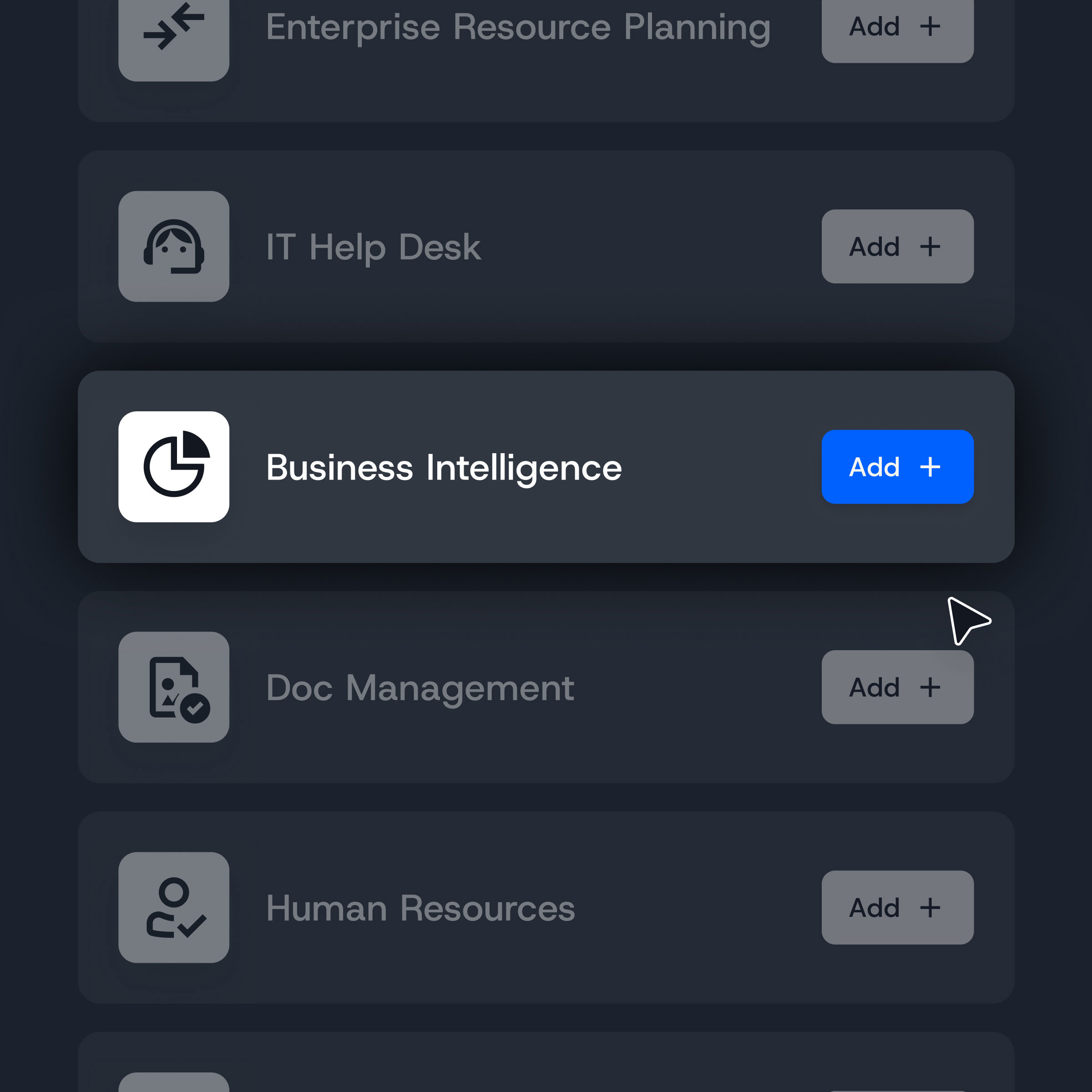

Powerful integrations

Teamwire provides SDKs and APIs for seamless integration with third-party software and services.

Additional key features for banks and financial institutions

Emergency alerts & panic button

Trigger instant alerts in the event of a security incident or IT outage — even if devices are muted. The integrated panic button automatically shares the user’s location and a voice message, enabling an immediate and coordinated response.

Live location sharing

Share your live location with colleagues. A detailed, configurable map displays all active locations, helping teams maintain full situational awareness — ideal for branch operations, crisis management, or mobile teams.

Read receipts and reports

Check at a glance who has received and read regulatory notifications or security directives — an essential feature for audit trails and compliance documentation.

Replying and forwarding messages

Respond directly to individual messages or forward critical updates to relevant stakeholders — quickly, securely, and without losing context.

@Mentions for targeted communication

Tag team members to draw attention to specific messages or request input. @Mentions override mute settings, ensuring that urgent updates are always noticed.

Pinned messages

Pin up to five key messages — such as compliance instructions, IT alerts, or approval notices — at the top of the chat. This keeps vital information visible and accessible, even during high message volume.

Available across all devices

Teamwire runs on iOS, Android, Windows, Mac, Linux, and via a secure web client. All devices stay synchronized in real time — ideal for hybrid and globally distributed teams.

Data minimization

Teamwire only processes the data strictly necessary to provide its services — no tracking, no metadata profiling, and fully GDPR-compliant by design.

Organizational directory built for the financial sector

Access a structured directory with all organizational contacts and distribution lists across teams, departments, offices, and regions. Create detailed user profiles for efficient and compliant internal collaboration.

Close chats

Archive or close completed projects and communication threads with a single click. This reduces data retention, increases clarity, and enhances overall data security.

Federation between servers

Establish secure connections with selected external organizations — such as partners, subsidiaries, or supervisory authorities — through encrypted federation between Teamwire servers. This enables compliant, cross-organizational communication with full data sovereignty.

Typical use cases in the financial sector

Whether in banking, insurance, asset management, or FinTech — Teamwire supports your daily operations wherever speed, security, and coordination are essential. It also serves as a reliable fallback communication channel in the event of system failures or cyberattacks.

Instant coordination during client consultations

A customer at the counter needs an immediate answer about a loan, but the responsible colleague isn’t on-site? Teamwire securely connects branches, headquarters, departments, and remote staff in real time — fully GDPR-compliant and auditable.

Ensuring DORA compliance: resilient communication during IT outages and cyber incidents

Stay operational even when primary systems fail. Teamwire provides a secure backup channel for communication during cyberattacks or technical disruptions. Emergency alerts override silent modes, instantly reach all relevant teams, and enable coordination without relying on email, servers, or dispatch tools — ensuring compliance with DORA requirements at all times.

Reliable crisis and emergency communication

During IT outages, cyberattacks, security incidents, or urgent compliance instructions, Teamwire reaches all teams within seconds through group chats, alerts, broadcasts, and status messages.

Simplified coordination across locations

Whether it’s a request from a branch or collaboration in a project team, Teamwire replaces slow email chains with secure real-time communication — via text, images, documents, voice, or video.

Faster approval workflows without email back-and-forth

From budget approvals to four-eyes checks, Teamwire streamlines decision-making — fast, transparent, and fully auditable. No delays, no endless email loops.

Secure connectivity for mobile employees

Insurance advisors, investment specialists, and internal auditors are often on the move. Teamwire keeps them securely connected — mobile, compliant, and intuitive to use.

Eliminate shadow IT

Employees no longer need to rely on insecure consumer apps like WhatsApp. Teamwire offers the same intuitive user experience — but with 100% GDPR, DORA, and BaFin compliance.

Frequently asked questions (FAQs)

Teamwire is ideal for banks, savings banks, insurance providers, FinTechs, asset managers, and other regulated financial institutions — regardless of size or location. The platform can be flexibly adapted to your infrastructure, security standards, and compliance requirements.

Yes. Teamwire enables full compliance with DORA, particularly in the areas of communication security, operational resilience, and incident response. The solution is purpose-built for mission-critical communication processes in the financial sector.

Teamwire is based on a zero-trust architecture and uses multi-layer encryption. With hosting in Germany or on-premises, you retain full data sovereignty. All messages, metadata, and media files are completely protected — even in BYOD (bring your own device) environments.

Absolutely. Teamwire was designed for secure, mobile communication — whether on company devices or as part of a BYOD strategy. Field staff, branch employees, and auditors stay securely connected at all times via mobile, desktop, or web browser.

Very quickly. Teamwire integrates seamlessly into existing infrastructures without lengthy implementation phases. The intuitive interface and minimal training requirements ensure a smooth rollout — even across multiple sites.

Approvals, feedback, and decisions can be managed in real time — without email delays or media disruptions. Every action is fully traceable and audit-proof, supporting internal governance and regulatory compliance.

Yes. Teamwire integrates effortlessly with your existing IT environments and security policies. Centralized administration, role-based permissions, and flexible APIs enable efficient and compliant operations.

All data is encrypted to the highest standards, processed exclusively in Germany, and archived in a tamper-proof, audit-compliant manner. This ensures confidential customer data never falls into the wrong hands — internally or externally.

In critical situations, Teamwire ensures instant reachability across all relevant teams. Using group alerts, broadcasts, and status messages, information can be shared and responses coordinated quickly — even when primary IT systems are unavailable.

A banking messenger simplifies internal and external collaboration, improves information flow, accelerates processes, and boosts overall productivity. By eliminating shadow IT and replacing insecure apps like WhatsApp, financial institutions can also avoid significant fines from regulators such as BaFin or the SEC.

A professional banking messenger should not only be GDPR-compliant and highly secure but must also ensure strict compliance with BaFin and DORA requirements — including full communication archiving. It should be resilient, intuitive, and as easy to use as WhatsApp.

Both cloud-based Software-as-a-Service (SaaS) and on-premises solutions are available for banks. These can be deployed quickly and centrally managed across the entire organization, giving administrators full control over all users, devices, and policies.